Belt and Road debt traps

Countries which borrow a lot have to repay their loans at some point.

As the recent excellent paper by Sebastian Horner et al. here lays out, there’s a lot of Belt and Road Initiative (BRI) lending out there, possibly more than anyone realized.

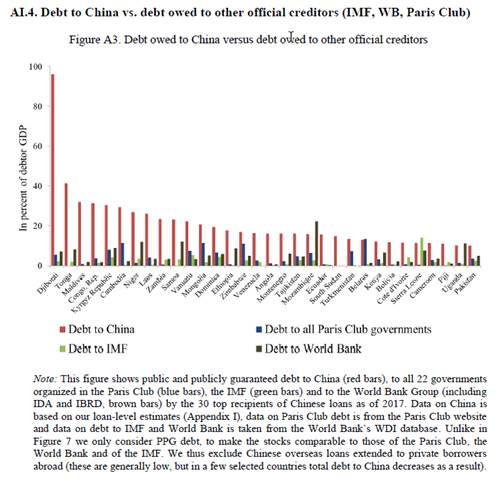

As this chart shows, debt to China is between 20-30% of GDP for most of the top 20 debtors, as assessed by the authors. Add to that assorted other debts to other governments, the World Bank and the IMF.

Fans of BRI invariably talk about how all the BRI infrastructure is going to generate growth – and thus presumably the revenues to service and then repay these loans. It would be super-great too if the projects could generate US dollar receipts, since that is how BRI loans will need to be repaid (see here for a crowd-sourced discussion of that). (Short summary: Belt & Road is a huge and quite risky long-dollar/short-renminbi trade disguised as an infrastructure program).

There’s been discussion of “debt trap diplomacy” – that Beijing was intentionally trapping its borrowers. And then, of course there were critiques of the “debt-trap diplomacy” critique, which have variously pointed out that (1) it has only been in Sri Lanka where Beijing has taken collateral (2) there’s loads of debt forgiveness and (3) Beijing is not intending to entrap these countries.

On the first criticism, it is still early days. On the second, yes there have been some cases, but it is usually pretty small-scale borrowing. And I think a good push-back for the third argument is US sub-prime mortgage lending. Countrywide did not intend to entrap its borrowers – it was aiming for a win-win with its borrowers no doubt – but the end result was horrible anyway.

Now, for this debate to be resolved we need some metrics for measuring how able the borrowers will be to repay these loans.

Unfortunately, repayment ability is hard to evaluate – it depends on all manner of assumptions about economic growth, tax revenues and other spending requirements. The supporters of BRI say that all the infrastructure will catalyze more growth; others point out that these projects are expensive and unlikely to do much for their local economies. You can point to examples of both.

But since most BRI loans are denominated in US dollars, these countries will have to earn dollars. And you usually do that by exporting more than you import.

So it would be a good idea for China to be lending to countries which either have a current account (C/A) surplus – or which are projected to have one soon.

We can lean on the IMF for some data. Here are some interesting charts which hopefully throw some light on this question.

First up, apologies to the Kiel papers’ authors, but I eye-balled their numbers for the “debt to China” in chart above as I could not see if they had published the data or not.

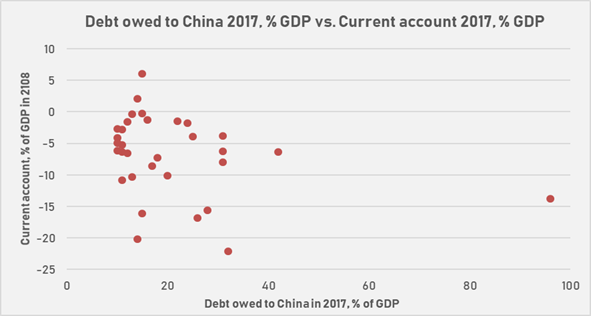

I then plotted debt to China in 2017 against the C/A, both as a share of GDP. Most economies are running a C/A deficit. Not a great start.

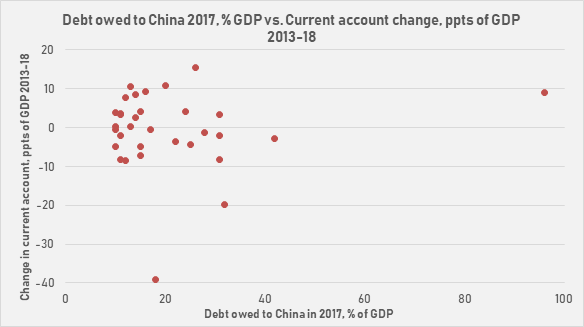

You might be wondering if BRI has exacerbated these countries’ current account deficits. After all, when you borrow BRI money from China you’re usually going to be importing a lot of machinery and raw materials.

Here I show debt to China against the 2013-18 change in the C/A. There is not much of a relationship. Of course, there are other things going on, commodity prices and global trade stagnating.

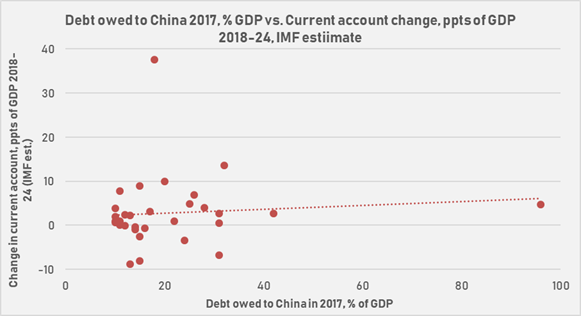

But that’s history – what about the future? Well, here are IMF projections for the C/A in 2024 for the big BRI borrowers. Pretty much every one of them will still be running a C/A deficit. Not good news.

That said, the IMF may be already factoring in interest repayments to China, which should logged in the income line of the C/A. (Repayment of principal will get logged in the financial account.)

(Though one of the arguments of the Kiel paper is that some of the BRI debt is disguised/not reported, and even when it is, the interests may not be known to the IMF.)

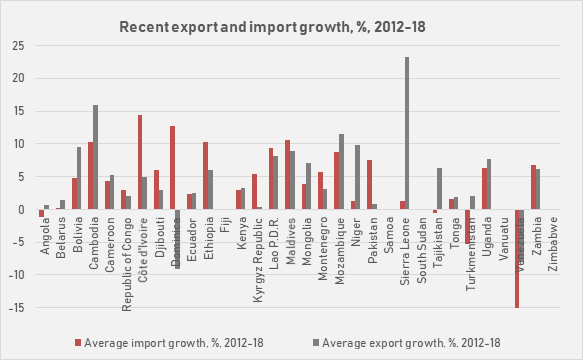

The IMF do not publish separate projections of the goods and services lines of the C/A (which exclude debt interest). But they do forecast export and import growth rates. Here they are.

The IMF are hopeful that for most countries export growth will exceed import growth. The median project for exports is 6% a year, against 4% for imports during 2018-24.

This would be a turnaround for most borrowers from recent years – the median import growth during 2012 was 5%, the same as for exports.

Maybe BRI projects will support borrowers’ export growth and attract FDI. That’s certainly the game-plan for borrowers like Pakistan and Ethiopia, which see Special Economic Zones, filled with manufacturing, as the way out of the incoming balance of payments crisis. They hope thus to repeat the China model. The differences, though, are that back in the 1980s, China was not borrowing that much from the rest of the world (wisely), and most of the inward investments from Hong Kong and Taiwan were equity stakes, not loans. Equity only gets paid if it is successful.

In short, if the BRI projects do not work, we are going to have a problem.